First-time homebuyer or repeat buyer, we’ve got you covered. Here are some of our top homebuying tips from credit scores and down payments to choosing a real estate agent or builder.

Homebuying Basics

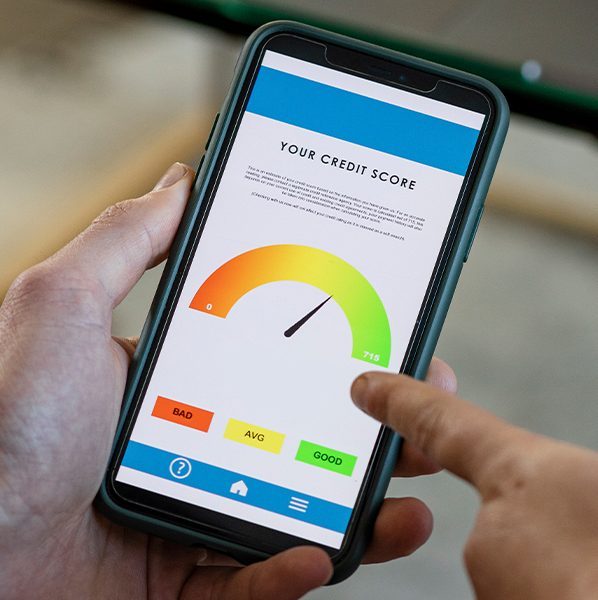

Getting a Mortgage

Here are pointers on preparing paperwork, lowering a down payment, and what to expect if you’ve got a new job or student loans.

Real Estate Tips

Check out these resources for tips on choosing a real estate agent, winning a bidding war, and saving money on your move or sale.