Consider this: You’re a happy homeowner, paying your mortgage each month. But you couldn’t help but wonder — could you pay off your home loan faster? The short answer: Yes, you can…

Category: Planning

What’s going through your head when you submit payment to your mortgage lender every month? Are you questioning whether you have the best mortgage terms possible, or are you having…

If your home has been destroyed or damaged by a fire, you are likely feeling overwhelmed. It can be difficult to know where to start when it comes to cleaning up and rebuilding, but Mr….

House floods can happen for a lot of reasons, including rising ground water, falling rain water, or a home water system malfunction. House floods can be sudden, and unfortunately they…

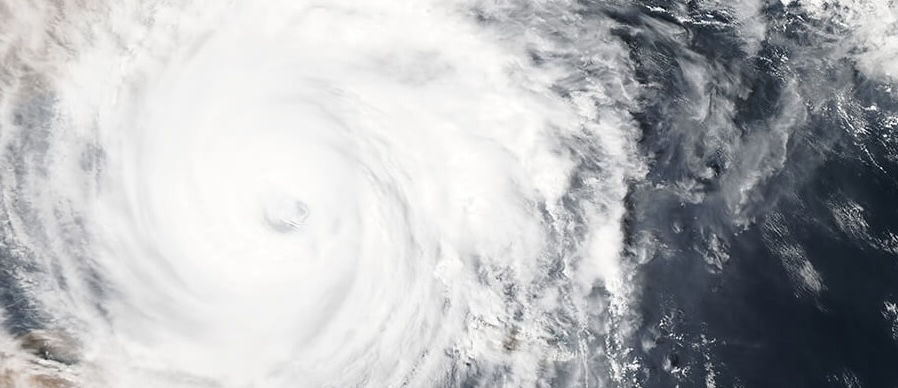

Hurricanes affect many parts of the United States each year, damaging homes and buildings, knocking out power and running water, and often posing a major safety threat to people in…

If a tornado is headed your way, you want to be properly prepared with tornado safety basics in mind. Here are six common myths about tornado safety you shouldn’t listen to—and some…

Feeling overwhelmed by your high-interest debt? A cash-out refinance can be an effective way to consolidate your high-interest debt. At its core, a cash-out refinance is a way to leverage…

Estimated reading time: 4 minutes When you see local weather reports that a storm is about to hit, your best bet is to prepare for the worst. You don’t want to be caught off guard…